Outline

New York State Employers: 2024 Salary Basis Thresholds Raised

April 17, 2024

Recently, we received news about the Salary Basis Thresholds Raised in New York for executive and administrative employees to meet the exemption from overtime, distinct from the upcoming raises in salary thresholds for pay frequency purposes.

Key Insights:

- The New York State labor department has sanctioned updated minimum salary thresholds for exempt executive and administrative employees, applicable for the next three years.

- Commencing on December 31, 2023, the revised minimums stand at $1,200 weekly for New York City and Nassau, Suffolk, and Westchester counties, and $1,124.20 weekly for the remaining areas of the state.

- Effective March 13, 2024, the salary thresholds for exemptions from pay frequency regulations will rise from $900 weekly to $1,300 weekly.

Thresholds for Overtime Exemption Salaries

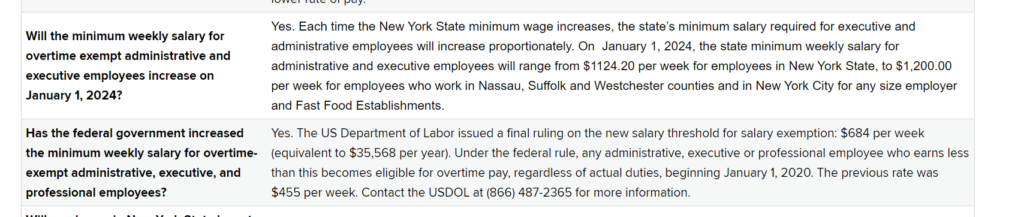

The New York State Department of Labor (NYDOL) issued a notice of adoption in the New York State Register on December 27, 2023, announcing an increase in the minimum salary thresholds for exempt executive and administrative employees. The new thresholds are set at $1,200 per week (approximately $62,400 per year) for New York City and its neighboring counties, and $1,124.20 per week (approximately $58,458.40 per year) for the remainder of the state. These thresholds will incrementally rise each year until 2026 under the new regulations.

Additionally, the New York Legislature revised the New York Labor Law (NYLL) to raise the salary threshold for exemptions from pay frequency regulations for executive, administrative, and professional employees from $900 to $1,300 per week, starting March 13, 2024.

The elevated salary thresholds for executive and administrative employees coincide with the January 1, 2024, increase in New York’s minimum wage, which stands at $16 per hour for New York City and downstate regions (Nassau, Suffolk, and Westchester counties), and $15 per hour for the remainder of the state.

Executive and Administrative Employees

According to Section 142-2.14 of the New York Codes, Rules, and Regulations (NYCRR), employees fulfilling an “executive” or “administrative” role and receiving a “salary” equal to or exceeding the thresholds established by state regulations may be exempt from New York’s overtime pay mandates. The NYDOL has scheduled annual raises to these thresholds for the upcoming three years starting in 2024, outlined as follows:

New York City and the rest of “downstate” (Nassau, Suffolk, and Westchester counties):

- $1,200 per week ($62,400 per year) on January 1, 2024

- $1,237.50 per week ($64,350 per year) on January 1, 2025

- $1,275 per week ($66,300 per year) on January 1, 2026

The rest of New York State (areas outside of New York City and Nassau, Suffolk, and Westchester counties):

- $1,124.20 per week ($58,458.40 per year) on January 1, 2024

- $1,161.65 per week ($60,405.80 per year) on January 1, 2025

- $1,199.10 per week ($62,353.20 per year) on January 1, 2026

Professional Employees

Workers engaged in a “bona fide … professional capacity” (as stated in the original text) may also qualify for exemption if they satisfy the criteria outlined in Section 142-2.14 of the NYCRR, which does not specify salary thresholds akin to those for employees in executive or administrative roles. The recent NYDOL regulations maintain these provisions unchanged.

The Fair Labor Standards Act (FLSA) sets the federal minimum for exempt professional employees at $684 per week or $35,568 per year. Although this minimum remained unchanged for 2024, the U.S. Department of Labor (DOL) introduced a proposed rule in August 2023 aimed at substantially increasing the minimum weekly salary to $1,059 per week, equivalent to $55,068 per year. However, the proposed rule has yet to be finalized.

Separate Salary Threshold Increase for Pay Frequency

New York has raised the salary thresholds for certain employees under Article 6 of the NYLL from $900 to $1,300 per week, effective March 13, 2024. These thresholds create exemptions from Article 6 requirements on pay frequency, direct deposit consent, and timing of benefits for executives, administrative, and professional staff.

According to New York legislation, “manual workers” must be paid weekly, while non-manual employees and those not qualifying for exemptions must be paid at least twice a month. Litigation over pay frequency has increased, leading to class actions.

FAQ for NYC 2024 Salary Basis Thresholds

Does the minimum wage rate depend on where a business is located, or where employees work?

The minimum wage is based on where an employee performs work. Workers must be paid the minimum wage rate for their work location regardless of where the main office of their employer is located.

Do multiple minimum wage rates have to appear on an employee’s pay stub?

Yes. If an employee earned wages at more than one rate of pay for the earning period, those rates must appear on the employee’s pay stub.

Do all employers in New York State have to pay the minimum wage?

No. While nearly every employer must pay the New York State minimum wage, there are some very specific exceptions, which only apply to certain employees or employees of public entities. More Information

Can a New York State employer change an employee’s rate of pay from a weekly salary to hourly rate?

Yes. An employer can change an employee’s rate of pay with advanced notice. Most employees, regardless of their rate or method of payment, must be paid overtime after 40 hours of work per week.